does cash app report crypto to irs

Currently Coinbase sends Forms 1099-MISC to users who are US. But the good news is that Zelle is not subject to the same reporting laws as third-party payment networks.

Malaysians Turn To Crypto Trading Amidst Lockdown Trading Turn Ons Cryptocurrency Trading

It is your responsibility to determine any tax impact of your bitcoin transactions on Cash App.

. Does Coinbase report to the IRS. The 1099-B is mainly for money youve made or lost from brokerages and related businesses. The same reporting laws as third-party payment networks.

Zelle however does not offer this option. What is the new rule and reason behind this modification. For transactions that took place in the 2022 tax year you will receive a 1099-K in 2023 if you receive more than 600 using cash apps.

1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to the Internal Revenue Service. However the American Rescue Plan made changes to these regulations. Does Cash App report to the IRS.

The answer is very simple. Considering the inherent tax risks failing to usereport it to the IRS and the customer if. Personal Cash App accounts are exempt from the new 600 reporting rule.

A copy of the 1099-K will be sent to the IRS. By Tim Fitzsimons. Make sure you fill that form out.

Coinbase has received a lot of criticism for issuing the 1099-K. Not filing your cryptocurrency taxes is considered tax fraud and is punishable through a maximum penalty of 100000 and potential jail time. According to Cash Apps FAQ anyone who trades Bitcoin will get a Form 1099-B which Cash App will send to the IRS.

The threshold for most states is 20000 along with 200 transactions set by the IRS. Starting January 1 2022 if your Cash for Business account has 600 or more in gross sales in the 2022 tax year it will qualify for a Form 1099-K and Cash App is required to report it to the IRS. Reporting Income from Cash Apps.

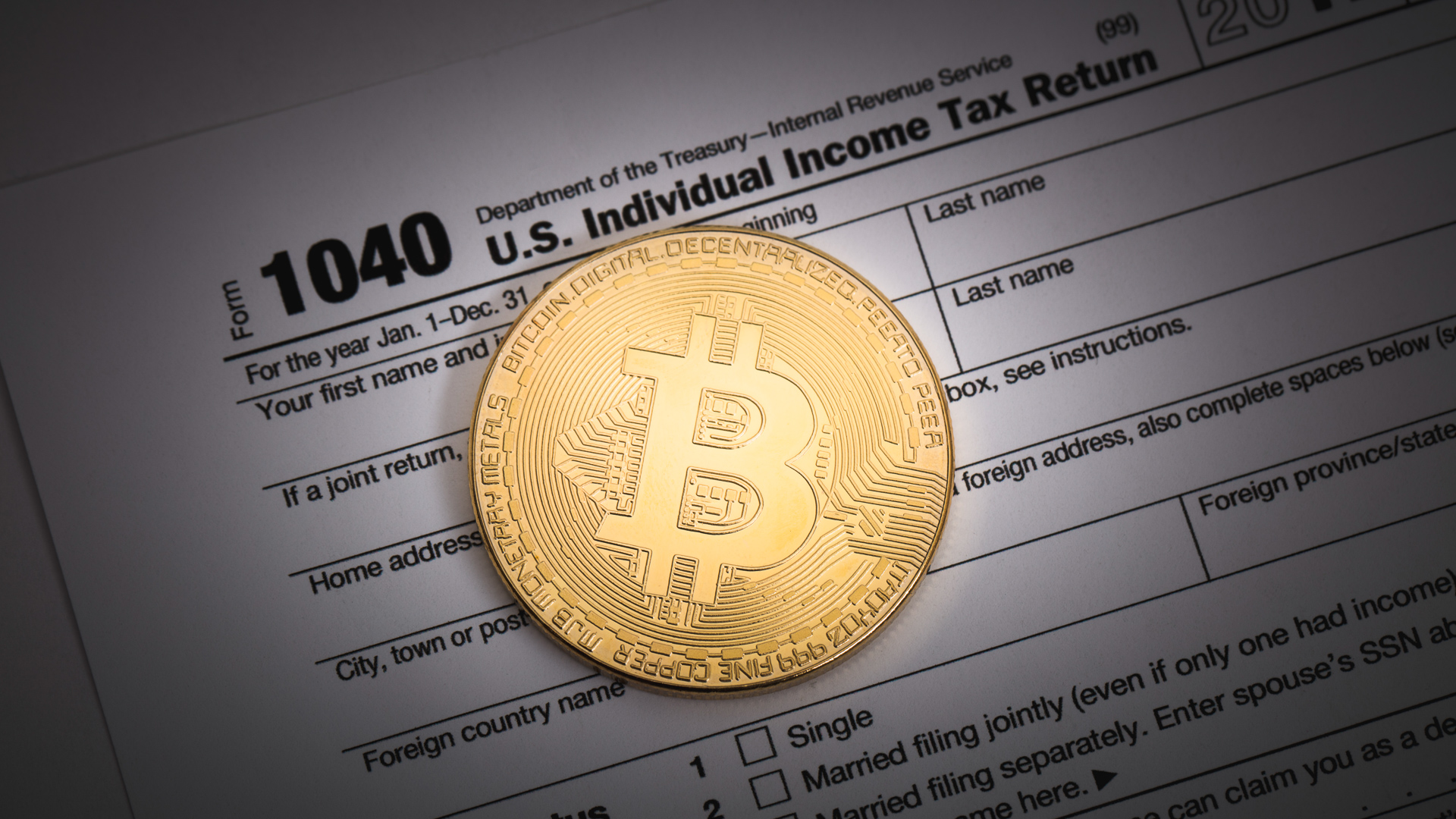

For those still needing to file the IRS issued a revised tax form which specifies on the top of the first page asks whether the individual owns cryptocurrency or not. So what does Cash App report to the IRS anyway. For most taxpayers who have fairly simple taxes and they.

And thats the reason Coinbase de-committed from that form. Get help dealing with the IRS. If users exceed this threshold they should expect to receive a 1099-K form in the mail on or before Jan.

Any 1099-B form that is sent to a Cash App user is also sent to the IRS. Remember there is no legal way to evade cryptocurrency taxes. If you have sold Bitcoin during the reporting tax year Cash App will provide you with a 1099-B form by February 15th of the following year of your Bitcoin sale.

Traders and made more than. What Does Cash App Report to the IRS. These forms are sent to both the user and the IRS.

According to PayPals crypto guidelines users who buy sell or transact in cryptocurrencies on its platform must participate in 1099 information reporting. The new rule will come into effect from 1 st January 2022 which means from next year onwards. Depending on the structure of your business many forms could be employed.

The IIJA will require businesses to treat digital assets like cash for purposes of this reporting requirement. Although here were just mainly interested Cash Apps direct involvement in the Bitcoin market. So much that in 2020 Coinbase announced that it would no longer be issuing 1099-K s for trading.

Do I qualify for a Form 1099-B. Beginning this year Cash app networks are required to send a Form 1099-K to any user that meets this income threshold. Now cash apps are required to report payments totaling more than 600 for goods and services.

You may be aware that when a business receives 10000 or more in cash in a transaction that business is required to report the transaction including the identity of the person from whom the cash was received to the IRS on Form 8300. Starting January 1 2022 if your Cash App Business account has gross sales of 600 or more in a tax year Cash App must provide a Form 1099-K to the IRS. If you use cash apps like Zelle Venmo or PayPal to make business transactions some modifications are coming to what those applications report to the IRS.

Contact a tax expert or visit the IRS website for more information on taxes. The IRS has still not issued any guidelines on what 1099 crypto reporting should be for crypto exchanges. This new 600 reporting requirement does not apply to personal Cash App accounts.

PayPal issues 1099-K forms to users when they complete 200 transactions in a calendar year and their gross payment volume exceeds 20000. You will often include a Schedule C with your Form 1040 to disclose this income. Ahead of the April 18 tax deadline consumers will still need to report their crypto holding despite the 2023 bill.

Cash App does not provide tax advice.

Cryptocurrency News Is Crypto Good Money Sec And Initial Coin Offerings Mixing Crypto N Rewards Cryptocurrency Cryptocurrency News Initials

Infrastructure Bill Cracks Down On Crypto Tax Reporting What To Know

Does Cash App Report To The Irs

Making Money On Crypto Yes The Irs Expects A Cut Krdo

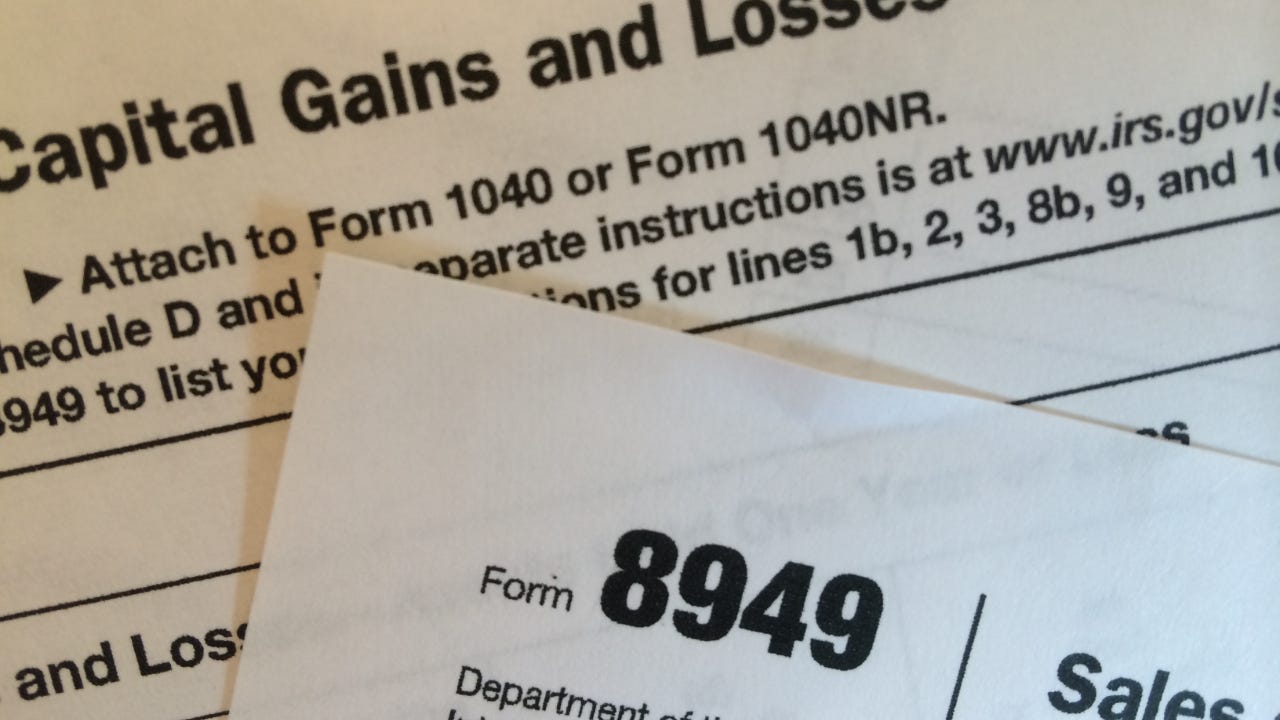

How To Attach And Upload Your Crypto 8949 To Your Tax Return

Calculate Your Crypto Taxes Ledger

Please Report The Bitcoin Com Wallet To The Ios App Store For Fraud Bitcoin Bitcoin Wallet Bitcoin Transaction

How To Pay The Right Taxes On Your Crypto Wallet

Does Cash App Report To The Irs

Sideshift App Demonstrates A Trade Between Lightning Network Btc And Tether Bitcoin Tether Usdt Bitcoin Lightning Network Tether Crypto Coin Networking

U S Treasury Calls For Irs Reporting On Crypto Transfers Above 10 000 Protocol

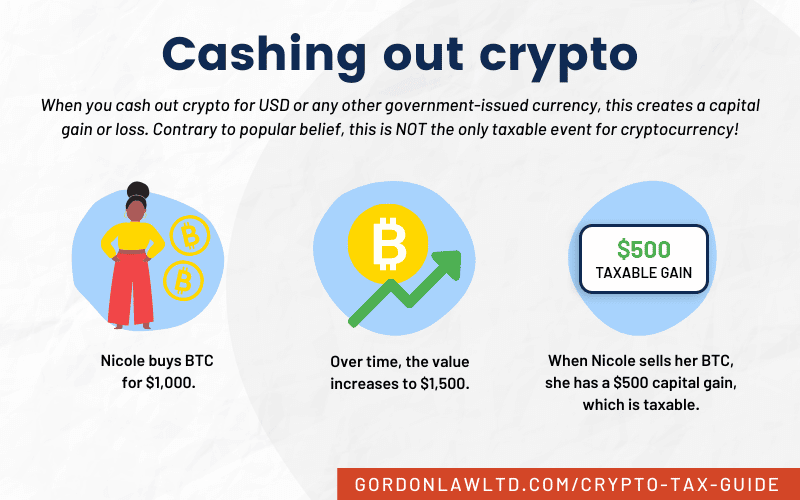

Easy Guide To Crypto Taxes For 2022 Gordon Law Group

Do I Have To Pay Taxes On Crypto Yes Even If You Made Less Than 600 Taxbit

The Irs S Crypto Question Might Change For Your 2022 Taxes Money

Does Cash App Report To The Irs

Easy Guide To Crypto Taxes For 2022 Gordon Law Group

Need To Report Cryptocurrency On Your Taxes Here S How To Use Form 8949 To Do It Bankrate

Cryptocurrency Taxation Regulations Bloomberg Tax

40 Of Crypto Investors Don T Know They Re Required To Pay Taxes What Else Are They Forgetting Gobankingrates