rsu tax rate calculator

On this page is a Restricted Stock Unit Projection calculator or RSU calculator. Property Tax By State.

Are Rsus Taxed Twice Rent The Mortgage

What Is Property Tax.

. Example Of RSU Life Cycle. Amount You Get Paid RSUs vs. County Related Services Rates.

How total compensation from RSUs is calculated and how the RSU tax rate is applied. The calculator will show you the total sales tax amount as well as the county city. Select a Transaction Type Purchase Bulk Construction Construction Conversion Leasehold Modification Refinance with Payoff Refinance with Consolidation Subordinate Mortgage.

Extra tax of 4310 due to loss of personal allowance as income above 100000 employee nic 2 431. Because there is no actual stock issued at grant no Section 83 b election is. For private and special act school district schoolage programs the 201920 prospective rate cannot.

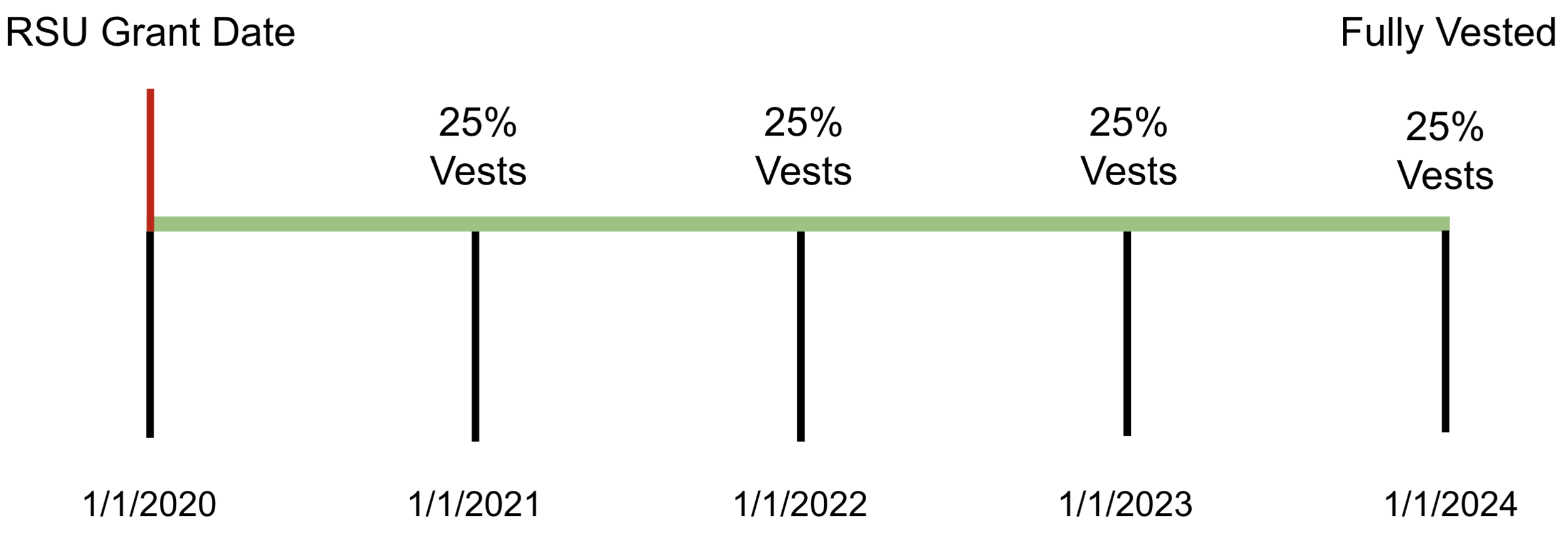

For the 201920 Prospective Rate. The of shares vesting x price of shares Income taxed in the current year. For academic purposes.

You can use our New York Sales Tax Calculator to look up sales tax rates in New York by address zip code. Basic Info for RSU Calculator Shares Granted Vesting Schedule Hypothetical Future Value Per Share Marginal Federal Tax Rate You can use the 2020 brackets below to estimate your tax. Special Education Itinerant Teacher Rates.

At any rate RSUs are seen as supplemental income. RSU tax at vesting date is. A app to help calculate how much tax you pay on RSUs A app to help calculate how much tax you pay on RSUs.

RSU Tax Treatment Key Dates. Vesting after making over 200k single 250k jointly. Whether youre a professional trader or a total newbie in the stock market this stock calculator will surely come in handy for example if you own a home valued at 100000.

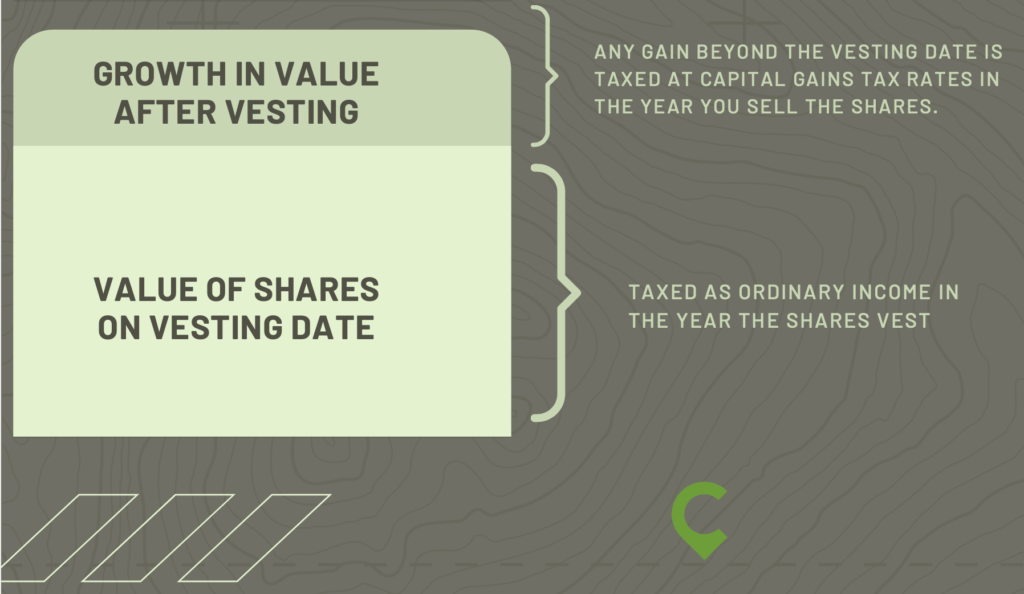

201920 tuition rates for schoolage programs. Integrated Day Cares Rates. The taxation of RSUs is a bit simpler than for standard restricted stock plans.

Long-term are capital items like RSUs that are held for more than one year after they were grantedobtained. The Rate Setting Unit establishes special education tuition rates for approved programs educating students with disabilities ages 3 to 21 years old who have been enrolled. This online calculator allows you to estimate both federal and state taxes due to an IPO or vested RSUs and is especially useful as it takes into account capital gains deductions and existing.

The value of over 1 million will be taxed at 37. For example if you are issued 10000 worth of RSUs as part of your compensation package you will pay ordinary income tax on 10000. Taxation of RSUs.

Vesting after Medicare Surtax max. If held beyond the vesting. If the rsus take you over 100000 you will pay income tax at a.

Most companies will withhold federal income taxes at a flat rate of 22. This brings me to another point. Vesting after Social Security max.

The following hypothetical example outlines the entire life cycle of an RSU grant. It is important for you to contact your tax advisor about the impact of these events. Enter details of your most recent RSU grant your companys vesting schedule and some.

If you choose to hold. There are two factors to consider when evaluating RSUs. Vesting after making over 137700.

Rsu Taxes Explained 4 Tax Strategies For 2022

Equity Compensation 101 Rsus Restricted Stock Units

Rsu Taxes Explained 4 Tax Strategies For 2022

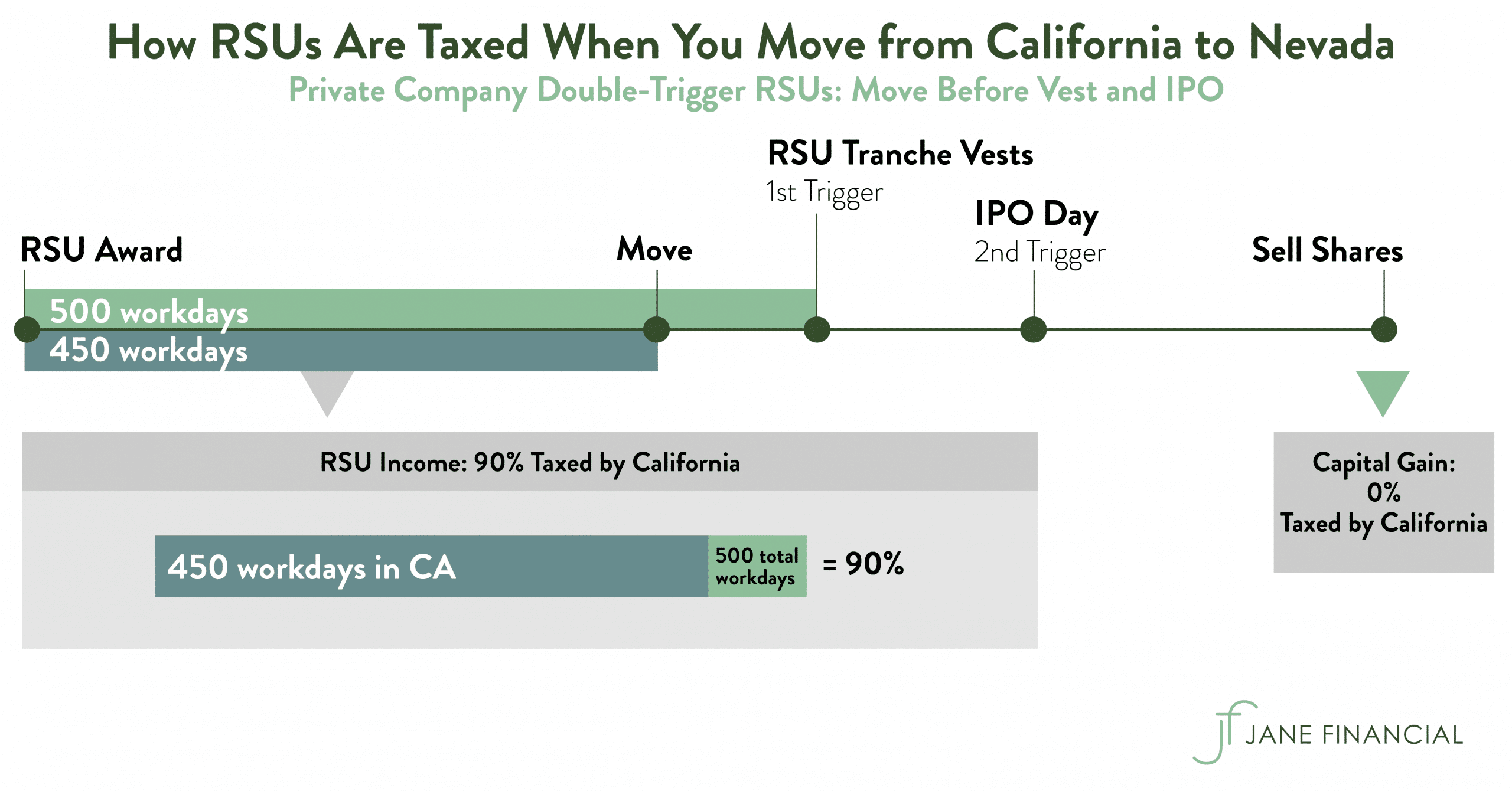

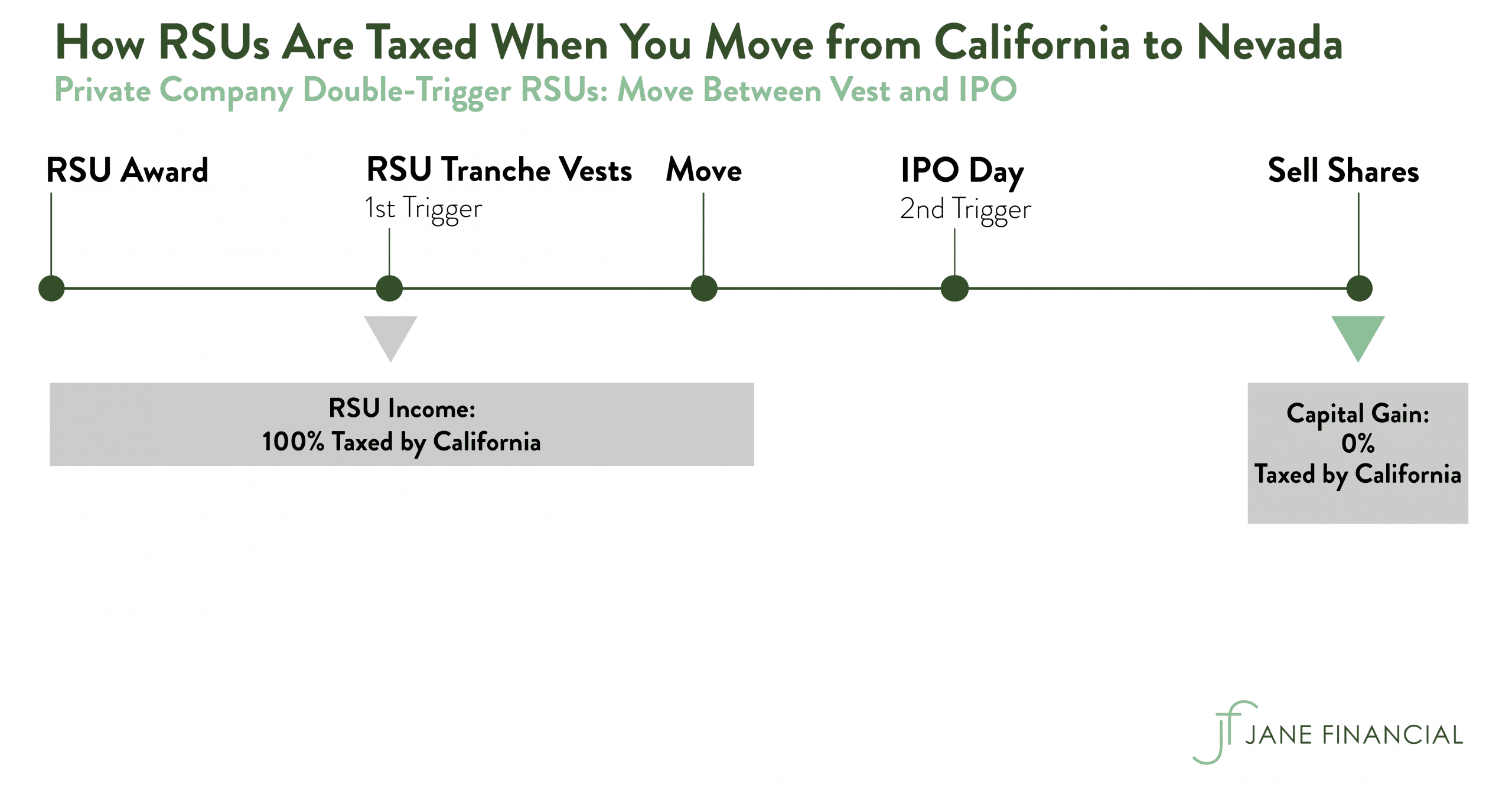

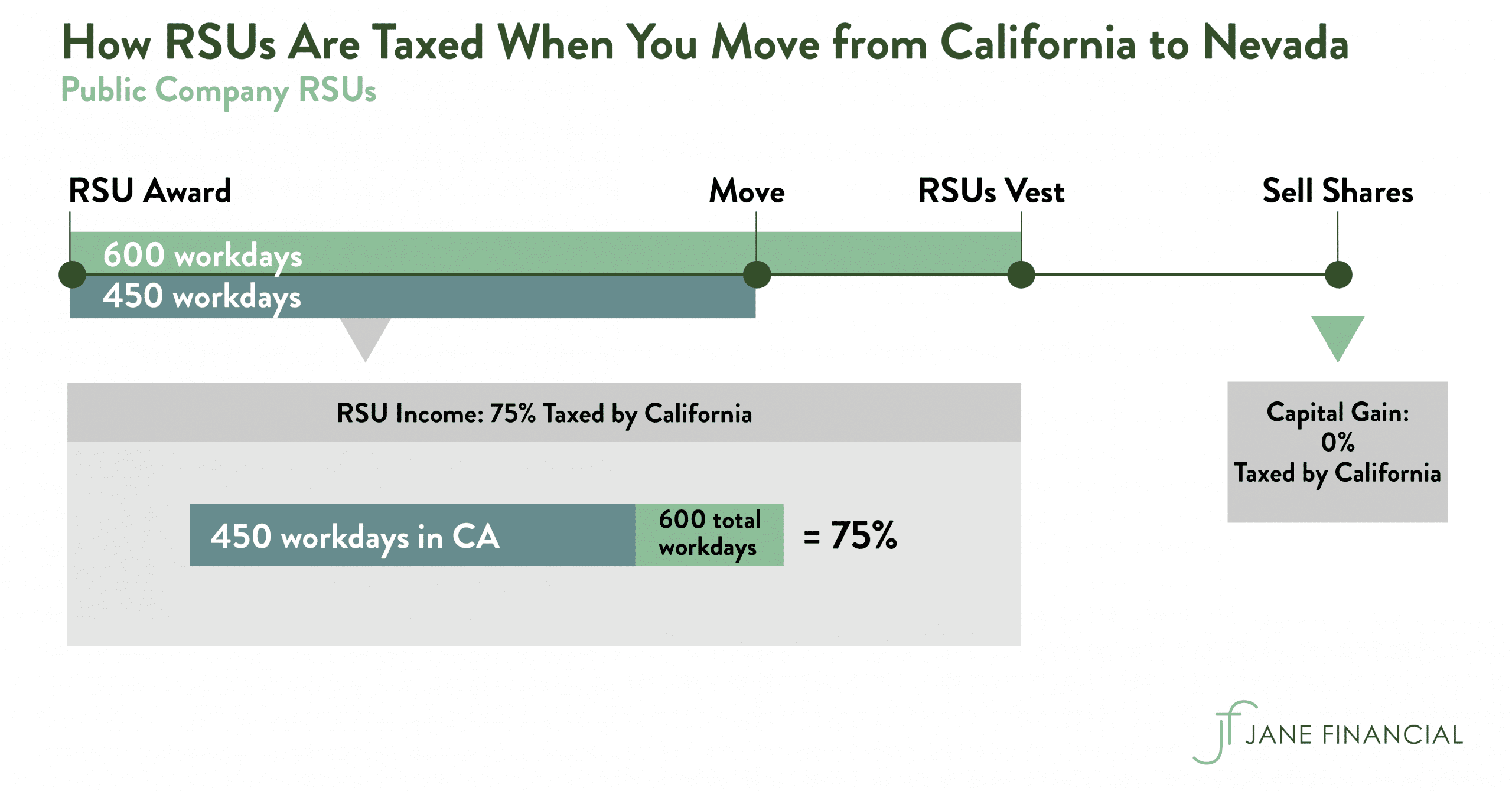

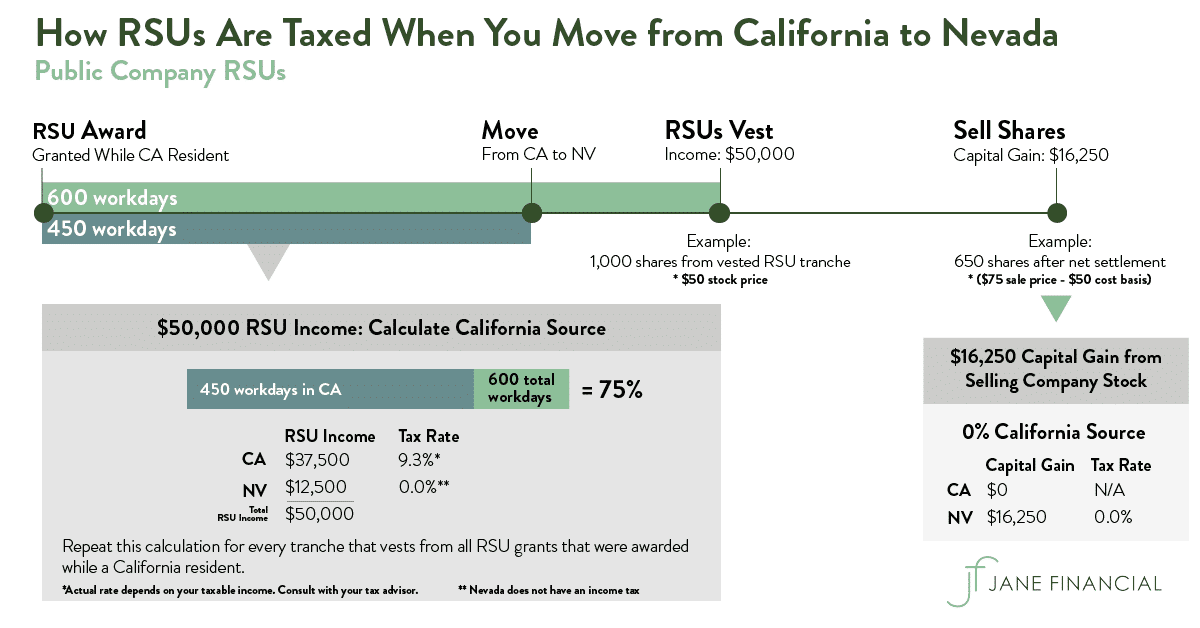

Restricted Stock Units Jane Financial

Rsu Calculator Projecting Your Grant S Future Value

Restricted Stock Units How Rsus Affect Your Clients Taxes Tax Pro Center Intuit

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

When Do I Owe Taxes On Rsus Equity Ftw

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Strategies For 2022

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

Don T Pay Tax Twice On Rsu Sales Parkworth Wealth Management

Restricted Stock Units Jane Financial

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

When Do I Owe Taxes On Rsus Equity Ftw