idaho sales tax rate 2020

Idaho sales tax details. You pay use tax on goods you use or store in Idaho when you werent charged or havent paid Idaho sales tax on them.

The County sales tax rate is.

. The County sales tax rate is. Sales tax New manufactured home sales clarified. Average Sales Tax With Local.

Single under age 65. The Idaho sales tax rate is currently. What is the sales tax rate in Idaho Falls Idaho.

The state sales tax rate in Idaho is 6 but you can customize this table as needed to reflect your applicable local sales tax rate. Plus 3625 of the amount over. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount.

House Bill 380 Effective January 1 2021. Depending on local municipalities the total tax rate can be as high as 9. Idaho has state sales.

Plus 4625 of the amount over. Plus 3125 of the amount over. Plus 1125 of the amount over.

Youll owe use tax unless an exemption applies. The minimum combined 2022 sales tax rate for Idaho Falls Idaho is. The December 2020 total local sales tax rate was also 6000.

What is the sales tax rate in Idaho City Idaho. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. Local level non-property taxes are allowed within resort cities if approved by 60 majority vote.

Collected from the entire web and summarized to include only the most important parts of it. Read more in our Use Tax guide. The corporate income tax rate is now 65.

Can be used as content for research and analysis. The Idaho sales tax rate is currently. EIN00046 12-21-2020 Page 54 of 63 15000 Your tax is 18000 Your tax is 21000 Your tax is 15000 15050 770 532 18000 18050 978 724 21000 21050 1186 923.

The current Idaho sales tax rate is 6. Plus 6625 of the amount over. Idaho Income Tax Rate 2020 - 2021.

There is no applicable county tax city tax or special tax. This page has the latest Idaho brackets and tax rates plus a Idaho income tax calculator. The Idaho City sales tax rate is.

31 rows The state sales tax rate in Idaho is 6000. There is no applicable county tax city tax or special tax. This is the total of state county and city sales tax rates.

Tax Rate. You can print a 6 sales tax table here. 270 rows Idaho Sales Tax.

The sales tax jurisdiction name is Boise Auditorium District Sp which may refer to a local government division. Instructions are in a separate file. State sales tax rates.

The state sales tax rate in Idaho is 6 but you can customize this table as needed to reflect your applicable local sales tax rate. The minimum combined 2022 sales tax rate for Idaho City Idaho is. Plus 5625 of the amount over.

Fast Easy Tax Solutions. Prescription Drugs are exempt from the Idaho sales tax. The Idaho tax rate is unchanged from last year however the.

Also some Idaho residents will receive a one-time tax rebate in 2021. Idahos 2022 income tax ranges from 113 to 693. The current total local sales tax rate in Jerome ID is 6000.

Boise Tax jurisdiction breakdown for 2022. Higher sales tax than 95 of Idaho localities. Form 40 is the Idaho income tax return for Idaho residents.

The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601. The Idaho ID state sales tax rate is currently 6. This includes hotel liquor and sales taxes.

Married filing separately any age. This is the total of state county and city sales tax rates. With local taxes the total.

Boise ID Sales Tax Rate. The December 2020 total local sales tax rate was also 6000. Idaho residents must file if their gross income for 2021 is at least.

For individual income tax rates now range from 1 to 65 and the number of tax brackets dropped from seven to five. 3 lower than the maximum sales tax in ID. Counties and cities can charge an additional local sales tax of up to 25 for a maximum possible combined sales tax of 85.

Ad Find Out Sales Tax Rates For Free. The 6 sales tax rate in Nampa consists of 6 Idaho state sales tax. The use tax rate is the same as the sales tax rate.

Single age 65 or older. Boise Idaho sales tax rate. 2020 Idaho State Sales Tax Rates The list below details the localities in Idaho with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator.

The 6 sales tax rate in Boise consists of 6 Idaho state sales tax. For tax rates in other cities see Idaho sales taxes by city and county. The Idaho Falls sales tax rate is.

Income tax tables and other tax information is sourced from the Idaho State Tax Commission. Idaho state income tax rate table for the 2020 - 2021 filing season has seven income tax brackets with ID tax rates of 1125 3125 3625 4625 5625 6625 and 6925 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. The current total local sales tax rate in Boise ID is 6000.

Idaho State Income Tax Rate 2020. 3 lower than the maximum sales tax in ID.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

States With Highest And Lowest Sales Tax Rates

Idaho House Passes 600 Million Income Tax Cut And Tax Rebate Bill Idaho Capital Sun

Change To Idaho Sales Tax Formula Impacts Boise Other Cities

Idaho State Income Tax Refund Status Id State Tax Brackets

Idaho Sales Tax Rates By City County 2022

U S Sales Taxes By State 2020 U S Tax Vatglobal

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Historical Idaho Tax Policy Information Ballotpedia

Idaho Income Tax Calculator Smartasset

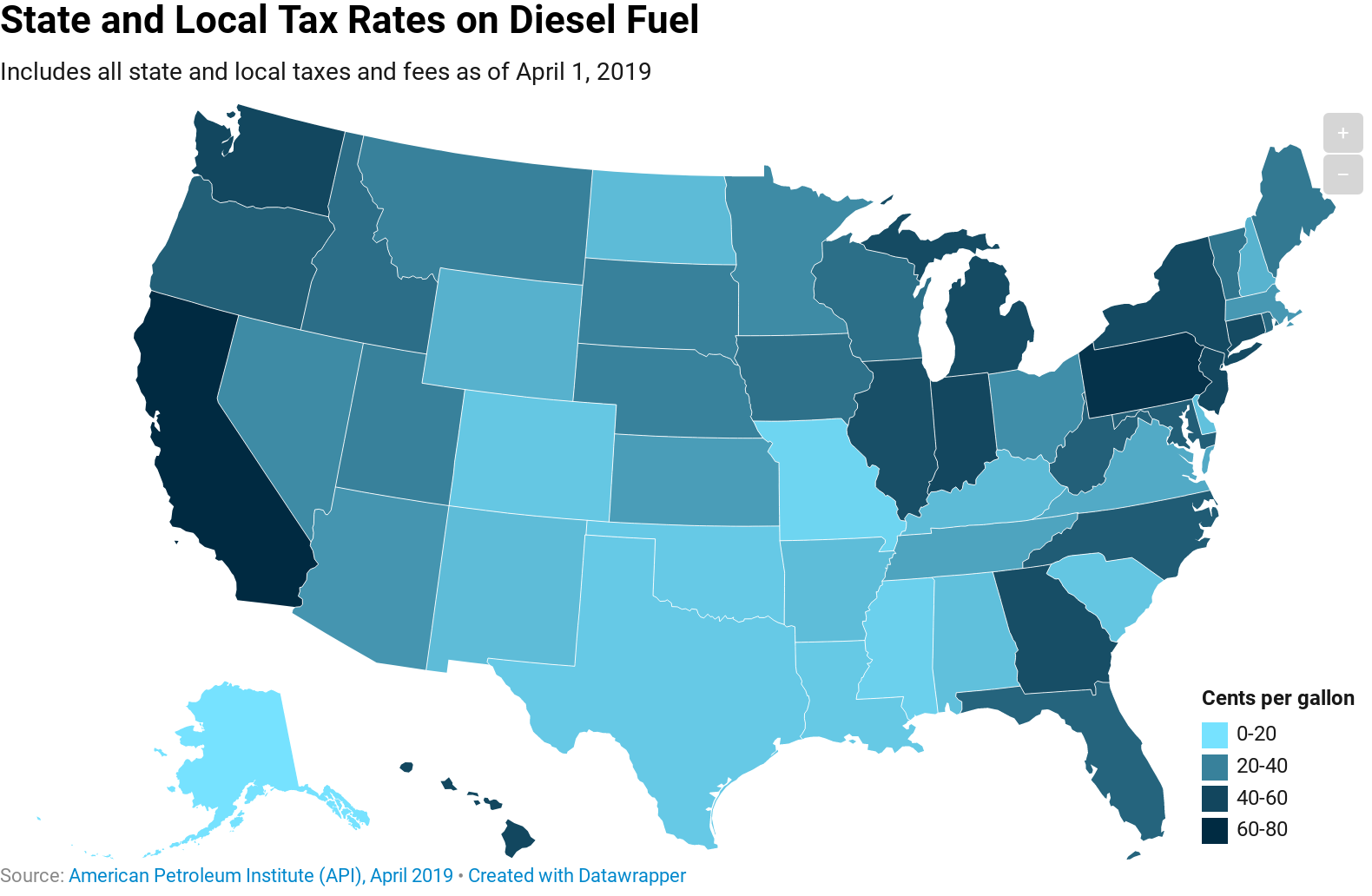

Gas Tax By State 2020 Current State Diesel Motor Fuel Tax Rates

How Much Federal Funding Does Idaho Get More Than Most States Idaho Statesman

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

How High Are Cell Phone Taxes In Your State Tax Foundation

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom

Idaho Sales Tax Small Business Guide Truic

Taxes Idaho Vs Washington Local News Spokane The Pacific Northwest Inlander News Politics Music Calendar Events In Spokane Coeur D Alene And The Inland Northwest